Employee Wellness/EFAP: Money Makeover

The “Money Makeover” is written to increase the financial literacy rates of VCH and Providence employees so they can make better decisions about money.

The scenario described in this article is a composite of common financial situations that FLC has encountered, presented through ‘Saanvi,” a fictitious individual/scenario.

As a VCH or Providence Health Care employee, the financial advisory services of the Financial Literacy Counsel are a part of your Employee Wellness/EFAP benefits. Your benefits include in-service workshops at the request of your manager, as well as two private financial counselling sessions per year to help you get your financial house in order and make sure you are on track to reach your financial goals. Simply reach out to Employee Wellness/EFAP at (604) 872-4929 or 1 (800) 505-4929 to get started.

Newly divorced and learning how to get retirement ready

Saanvi (a fictitious character based on a composite of FLC clients) and her husband had originally planned to retire at the same time 3 years from now. She has been a healthcare employee for the past 27 years and is now 57 years old with adult children aged 24 and 26 years.

When her husband expressed that he wanted to leave their marriage, she was in shock and reached out to Employee Wellness/ EFAP to help her adjust to her new normal. She also had to figure out how to take control of her finances, and get her financial house in order as her husband had managed most of the household finances.

Our integrated team of the counselling services of VCH Employee Wellness/ EFAP and Financial Literacy Counsel walked alongside her to build up her emotional, mental and financial resiliency. She had one pressing question regarding finances when she came in for her first meeting.

“Should I make changes to my retirement income plan and savings so that I can achieve $5,000 a month after taxes?”

| Income | Investment | ||

| Annual earnings | $80,000 | TFSA | $30,000 |

| After taxes | $54,000 | RRSP | $50,000 |

| Monthly income | $4,500 | Non-registered | $250,000 |

Saanvi earns $80,000 per year in her current role and nets about $54,000 per year or $4,500 per month after taxes and payroll deductions. Post-divorce, their family home in Richmond, BC was sold and her share of the sale after paying off the mortgage and realtor fees was $750,000.

She downsized and bought a modest condo with the proceeds for $500,000 and is investing the remaining $250,000 in a non-registered investment account with an investment advisor. She also has contributed $30,000 in savings inside a tax-free savings account (TFSA) and $50,000 inside a registered retirement savings account (RRSP), making a total of $330,000.

Based on her vision of retirement which includes helping her children financially, vacations and supporting charities close to her heart, we concluded that Saanvi needs $5,000 a month after taxes to reach her goals and to plan for a life expectancy of age 95.

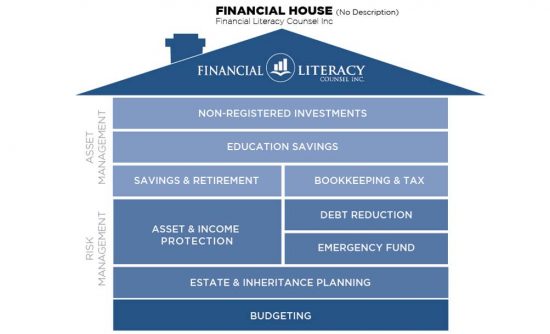

We took a 3-step approach to determine not only what changes she needs to consider to become retirement ready but also how to get her entire financial house in order as she navigates her new normal after her divorce.

Step 1A: Determining what can she expect from her pension between age 60-65 years

| Basic monthly pension at age 60: | $2,800 |

| + Bridge benefit until age 65: | $700 |

| TOTAL INCOME BEFORE TAXES | $3,500 |

| -Taxes | $700 |

| NET INCOME AFTER TAXES | $2,800 |

| Retirement income need: | $5,000 |

| -Net income after taxes | $2,800 |

| SHORTFALL: | $2,300 |

Step 1B: Determining what can she expect from her pension after age 65+ years

| Basic monthly pension at age 65 | $2,800 |

| +Bridge benefit AFTER AGE 65 | $0 |

| +Canadian Pension Plan | $850 |

| +Old Age Security | $550 |

| TOTAL INCOME | $4,200 |

| -Taxes | $950 |

| NET INCOME AFTER TAXES | $3,250 |

| Retirement income need | $5,000 |

| -Net income after taxes | $3,250 |

| SHORTFALL | $1,750 |

As for her pension, her earliest unreduced Single Life 10 pension at age 60 is estimated to be $2,800 with a bridge benefit of $700 until age 65. That means she can expect $3,500 per month or $2,700 after taxes from age 60-65 but after age 65, she will be receiving only $2,800 a month and looking to the Canadian Pension Plan (CPP) and Old Age Security (OAS) to kick in.

According to statements she received from the government, she is expecting to receive $850 per month from CPP starting at age 65 and her OAS will provide an additional $550 starting age 65. Therefore, when age 65 arrives, she will be receiving $2,800 from her pension and an additional $1,450 per month from both CPP and OAS for a total before considering her personal savings (RRSP, TFSA and non-registered) of $4,200 before taxes which will be about $3,500 after taxes.

Bottomline

In order to reach $5,000 per month, Saanvi has a shortfall of $2,300 a month between ages 60-65 and then $1,750 per month after age 65.

Upon realizing these figures, Saanvi decided she would like to take her pension at age 60 and work 5 to 7 casual shifts per month to address a majority of the $2,300 a month shortfall.

She will then focus on growing her personal investments of $330,000 at an average rate of 6.9% to make up the $1,750 a month shortfall after age 65 assuming she doesn’t contribute any additional savings.

Saanvi shared at the meeting:

I really appreciated learning about what my income shortfalls will be based on age 60 to 65 and after age 65, so I can plan based on real numbers rather than hoping it will all come together at the end. Now I know I have 8 years to get myself ready and choose investments that will earn me at least a 6% return.

Step 2: Bridging the gap to address Saanvi’s shortfall by age 65

Now that Saanvi knows what to expect from her pension and government benefits, it’s time to review her personal investments of $330,000 and determine the changes she needs to consider in order to meet her $1,750 a month shortfall by age 65.

| Personal investments of $330,000 consists of :

|

|

| Tax-free savings accoung | $30,000 |

| Registered retirement savings plan (RRSP) account | $50,000 |

| Non-registered account | $250,000 |

We explained that she will need at least $562,000 of capital in 8 years at age 65 to draw upon to safely withdraw and spend $1,500 a month after taxes from age 65 to age 95. So her $330,000 will need to achieve a rate of return of at least 6.9% compounded annually if she chooses not to save any money from now until age 65. If she can commit to saving $5,000 a year until age 65 in addition to the $330,000 she already has saved, then her rate of return will need to be at least 5.68%.

In either scenario, the best way to achieve that is to maximize investment programs and vehicles that take advantage of the power of compound interest that are not subject to yearly taxation on the growth of the investments.

So we recommended that she considers the following 3 changes:

- Recommended change #1: Maximize tax shelters such as her TFSA: The maximum contribution limit for TFSA’s from the years 2009 to 2018 is $56,000 and Saanvi only has $30,000 contributed so far. Topping up her TFSA’s is a prudent move so that she can enjoy the power of compound interest and not have to pay taxes on any growth she experiences on the investments inside her TFSA.

- Recommended change #2: Maximize tax refunds by topping up RRSP: Saanvi is off to a good start by having some RRSP’s totalling $50,000 however she also has $30,000 of unused contribution room. If she were to commit $30,000 to top up her RRSP’s, she would get a tax refund of about $8,400 based on her tax bracket which she can then put towards TFSA’s and grow that contribution on a tax-free basis.

- Recommended change #3: Consider investing her non-registered investments in corporate class mutual funds to defer paying taxes until she sells her investments: Saanvi’s non-registered account of $250,000 is made up various mutual funds, stocks and bonds chosen by her investment advisor which are earning about 6% growth every year which is great but the account is subject to taxes on a yearly basis because of the growth. In her case, committing $26,000 of her non-registered money to top up her TFSA and another $30,000 to top up her RRSP still means she will have $194,000 exposed to taxes inside her non-registered account. Therefore, she needs to consider speaking to a trusted investment advisor about how to include corporate class mutual funds into her planning.

Step 3: On going coaching to get her financial house in order

Getting retirement ready is only one aspect of getting Saanvi’s financial house in order after her divorce. There are other planning considerations especially in the areas of cashflow planning, insurance planning, estate planning and tax planning considerations that surfaced during her first meeting with a financial advisor.

She was glad to know that Employee Wellness/ EFAP provided two financial advisory consultations every year and they can be in conjunction with personal counselling as part of the suite of employee benefits that are available to employees of VCH and Providence Health Care.

After completing her two financial advisory consults she shared: “I feel like I’m more prepared and taking the steps necessary to become retirement ready.”

***

This article was written by Alphil from the Financial Literacy Counsel (in partnership with Employee Wellness/EFAP).

tellie

The chances of getting a 6.9% return net taxes and fees is unlikely, unless greater risk is taken in her choice of investments. I think better advice around expectation of returns is in order, and options for worse-case scenarios should her returns not meet expectation.